The Trading Platform That Finally Delivers Consistency

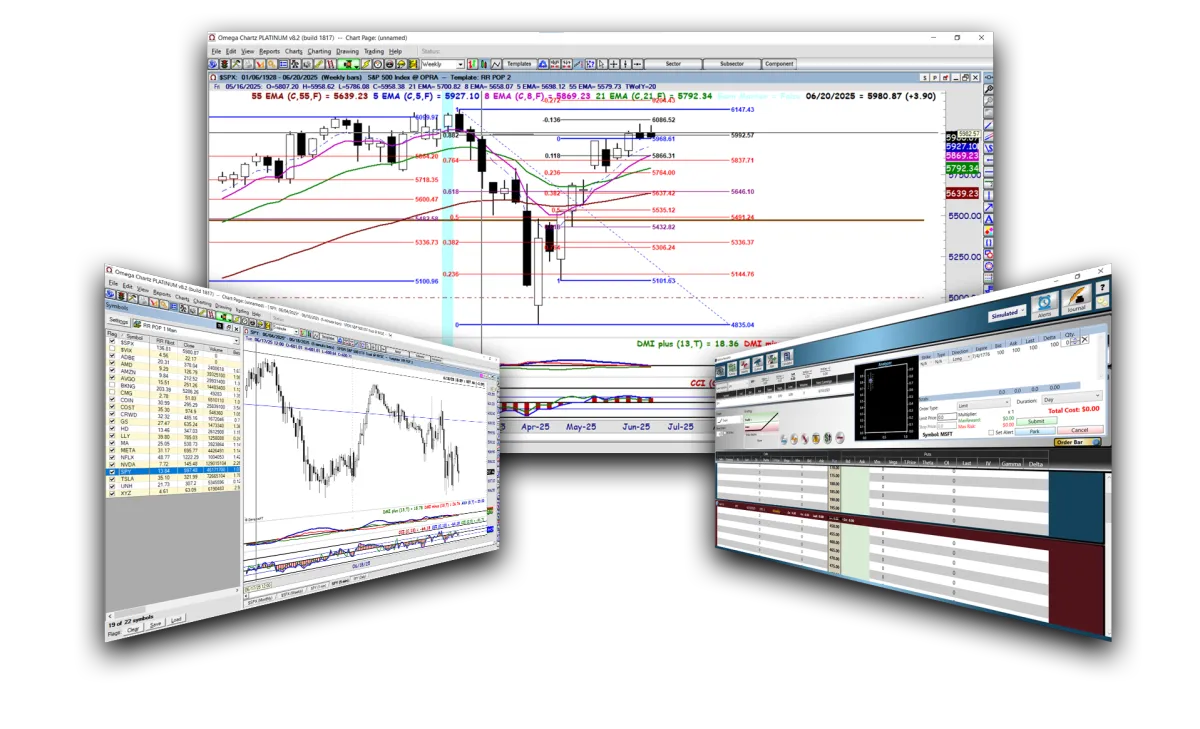

Built for serious traders who are tired of false promises, Omega Chartz is your all-in-one solution for charting, backtesting, and executing trades with confidence.

You’ve tried the courses. The gurus. The broker platforms.

And you're still stuck wondering why your results aren't consistent.

Maybe it’s not you.

Maybe it’s your tools.

Omega Chartz was built for traders like you — frustrated by incomplete systems, rigid platforms, and hype without substance.

Omega Chartz is a professional-grade platform for stocks, futures, forex, and options.

With 100+ years of historical data, powerful backtesting, and real-time chart trading — you’re in control from analysis to execution.

Whether you're a beginner or a seasoned trader, TN’s intuitive tools and unmatched support make consistency attainable.

Charting

Strategy Testing

Real-Time Trading

Built to Help You Trade Smarter — Not Harder

One-Click Chart Trading

Execute trades directly from your charts

100+ Years of Historical Data

Test strategies in real-world conditions

Custom Indicator Builder (TradeSense™)

No coding needed, just drag and drop

Strategy Backtesting & Replay

Know your edge before risking real money

Broker Integration

Trade live with supported brokers like CQG, Rhythmic & more

Trusted by World-Champion Traders and Market Legends

"Traders will cheer"

"Traders will cheer the versatility and power that Genesis provides.

- John Bollinger, CFA, CMT

"A crucial component"

"The [charting engine behind Omega Chartz] has been a crucial component of our proprietary trading operations for nearly 20 years."

- Peter Brandt

"The most intiutive package"

"I have been trading for 22 years. Genesis is the most intuitive package I have seen, and have recommended it to hundreds of traders."

-Markus Heitkoetter

How It Works

3 Simple Steps to Start Trading Smarter

1. Download Omega Chartz

Get started with a free trial

2. Connect Your Broker

Or practice with real market replay

3. Build Your Strategy

Use TradeSense™ or choose from ready-made templates

FAQs

Why should I pay for this when my broker offers free charts?

Most broker tools are designed for execution, not analysis or strategy. Omega Chartz gives you a full professional edge.

Is this hard to learn?

Omega Chartz is known for its intuitive layout, drag-and-drop interface, and 1-on-1 support.

Will it work with my broker?

TN connects with most major brokers including [LIST PLACEHOLDER]. Check compatibility [here].

Try it risk-free with our 30-day money-back guarantee.

Can I execute trades directly from Omega Chartz

Yes. Omega Chartz integrates with supported brokers like CQG and Rhythmic, allowing for one-click trading directly from your charts. It's ideal for active traders who want seamless execution from analysis to action.

What is TradeSense™ and how does it work?

TradeSense™ is our custom strategy builder that lets you design and test indicators and strategies without any coding. Just drag and drop logic blocks to create entry, exit, or alert conditions—and apply them to real-time or historical data.

How does the Pro Scanner help me find trades?

The Pro Scanner scans thousands of stocks or futures contracts in real time based on your criteria. Whether you're looking for breakouts, moving average crossovers, or volatility squeezes, the scanner helps you identify setups fast—before the crowd sees them.

What is the Trend Outlook Library?

The Trend Outlook Library is a proprietary toolset that visualizes high-probability trend continuations and reversals. It’s powered by historical pattern recognition and designed to help traders ride trends more confidently and exit before momentum dies out.

Are MVWAP bands just fancy indicators?

MVWAP (Multiple Volume-Weighted Average Price) bands are advanced institutional tools not found in most retail platforms. They give you real-time insight into where volume is concentrated, helping you time entries and exits with greater precision.

Here’s What You Get Today

Full access to Omega Chartz Standard

Advanced backtesting suite

Market replay tools

Access to TradeSense™ builder

Only $795

Free Data for 30 days

No contracts - cancel anytime

Ready to Finally Trade With Confidence?

Wealth Builders HQ - Copyright 2025 - All Rights Reserved

This site is not a part of the YouTube, Google or Facebook website; Google Inc or Facebook Inc. Additionally, This site is NOT endorsed by YouTube, Google or Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc. YOUTUBE is a trademark of GOOGLE Inc.

If you do not agree with any term or provision of our Terms and Conditions you should not use our Site, Services, Content or Information. Please be advised that your continued use of the Site, Services, Content, or Information provided shall indicate your consent and agreement to our Terms and Conditions.

By purchasing this training series, you consent for Wealth Builders HQ and its authorized vendors to contact you at the telephone number provided for marketing purposes, with the use of technology that may include automatic dialing or prerecorded technology. Msg & Data Rates May Apply. Text back STOP at any time to opt-out. Consent is not required to make a purchase.

Neither Freedom Management Partners, Wealth Builders HQ, or any of its personnel are registered broker-dealers or investment advisers. We will mention that we consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because we consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that we am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any particular individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also Freedom Management Partners’ personnel are not subject to trading restrictions. We and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Wealth Builders HQ may publish testimonials or descriptions of past performance but these results are NOT typical, are not indicative of future results or performance, and are not intended to be a representation, warranty or guarantee that similar results will be obtained by you. Wealth Builders HQ's coaches' experiences with trading is not typical, nor is the experience of traders featured in testimonials. They are experienced traders. Becoming an experienced trader takes hard work, dedication, and a significant amount of time. Your results may differ materially from those expressed or utilized by Warrior Trading due to a number of factors. We do not track the typical results of our past or current customers. As a provider of educational courses, we do not have access to the personal trading accounts or brokerage statements of our customers. As a result, we have no reason to believe our customers perform better or worse than traders as a whole.

Any figures and results discussed in this training are our personal results and in some cases the figures and results of previous or existing students. Please understand these results are not typical. We’re not implying you’ll duplicate them (or do anything for that matter). The average person who watches “how to” information webinars get little to no results. We’re using these references for example purposes only. Your results will vary and depend on many factors including but not limited to your background, experience, and work ethic. All business entails risk as well as massive and consistent effort and action. If you’re not willing to accept that, please DO NOT INVEST IN THIS TRAINING.

Available research data suggests that most traders are NOT profitable.

In a research paper published in 2014 titled “Do Day Traders Rationally Learn About Their Ability?”, professors from the University of California studied 3.7 billion trades from the Taiwan Stock Exchange between 1992-2006 and found that only 9.81% of day trading volume was generated by predictably profitable traders and that these predictably profitable traders constitute less than 3% of all day traders on an average day.

In a 2005 article published in the Journal of Applied Finance titled “The Profitability of Active Stock Traders” professors at the University of Oxford and the University College Dublin found that out of 1,146 brokerage accounts day trading the U.S. markets between March 8, 2000 and June 13, 2000, only 50% were profitable with an average net profit of $16,619.

In a 2003 article published in the Financial Analysts Journal titled “The Profitability of Day Traders”, professors at the University of Texas found that out of 334 brokerage accounts day trading the U.S. markets between February 1998 and October 1999, only 35% were profitable and only 14% generated profits in excess of $10,000.

The range of results in these three studies exemplify the challenge of determining a definitive success rate for day traders. At a minimum, these studies indicate at least 50% of aspiring day traders will not be profitable. This reiterates that consistently making money trading stocks is not easy. Day Trading is a high risk activity and can result in the loss of your entire investment. Any trade or investment is at your own risk.

Any and all information discussed is for educational and informational purposes only and should not be considered tax, legal or investment advice. A referral to a stock or commodity is for educational purposes only and is not an indication to buy or sell that stock or commodity.

Citations for Disclaimer

Barber, Brad & Lee, Yong-Ill & Liu, Yu-Jane & Odean, Terrance. (2014). Do Day Traders Rationally Learn About Their Ability?. SSRN Electronic Journal. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2535636

Garvey, Ryan and Murphy, Anthony, The Profitability of Active Stock Traders. Journal of Applied Finance , Vol. 15, No. 2, Fall/Winter 2005. Available at SSRN: https://ssrn.com/abstract=908615

Douglas J. Jordan & J. David Diltz (2003) The Profitability of Day Traders, Financial Analysts Journal, 59:6, 85-94, DOI: https://www.tandfonline.com/doi/abs/10.2469/faj.v59.n6.2578